Individuals are significantly exposed to a complex web of taxes when investing in businesses, property, and more diverse investment strategies.

Planning for your future, retirement and succession also involves intricate considerations where good advice from highly experienced consultants is a must.

Protect yourself, your family, and your future with specialist advice from an Intel Statement agency.

Ready-made service packages are a very profitable solution. Choose what you need:

Back to Basic

€ 2500

Level Up

€ 3500

Innovator

€ 5000

The first consultation is free!

The first consultation is free!

Tax planning advisory services

Tax return preparation

Income tax and national insurance

Capital gains tax planning

Tax risk consulting

Tax minimisation services

Tax optimisation services

Inheritance tax strategies

Tax audits

VAT refund

Optimisation of taxation

International taxation

Accounting support for business or investment activities

Each case is unique, so we suggest you choose tax consulting services separately:

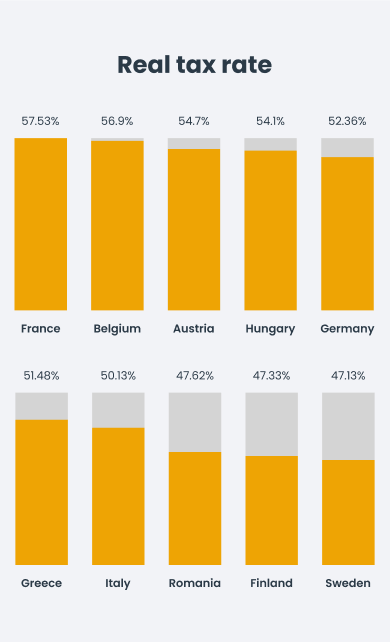

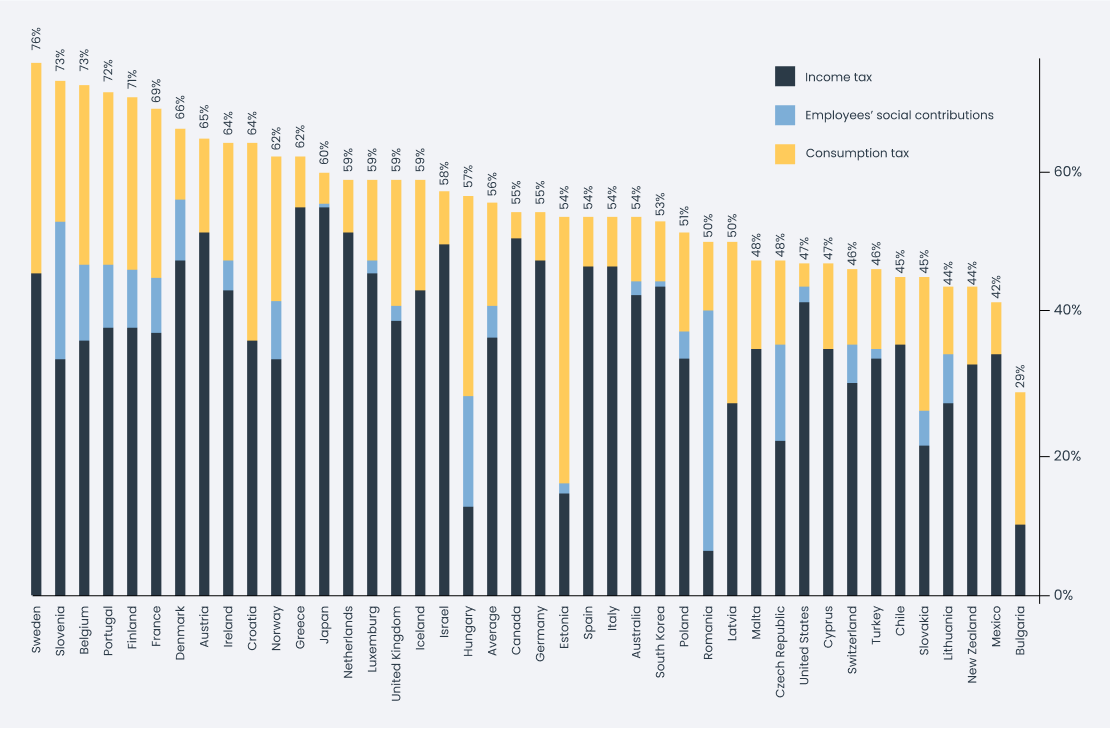

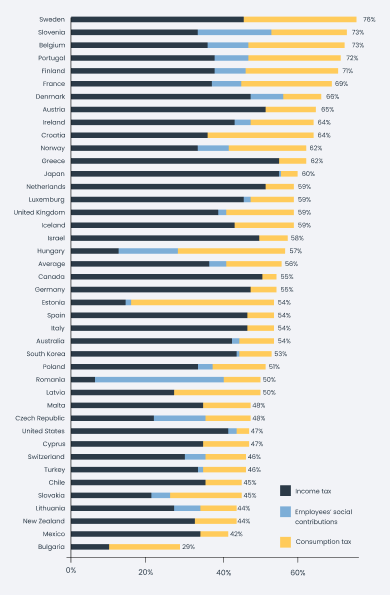

Countries differ in where the top marginal tax rate starts to apply. Mapping this would be very complicated, as taxes may have different thresholds. For example, the entry for solidarity taxes may differ from the top income tax bracket. Also, the maximum marginal tax rate is by no means consistently the highest since social security contributions often only apply up to a ceiling.

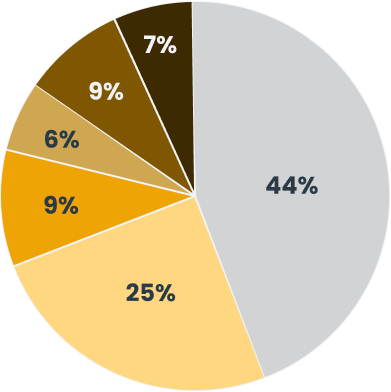

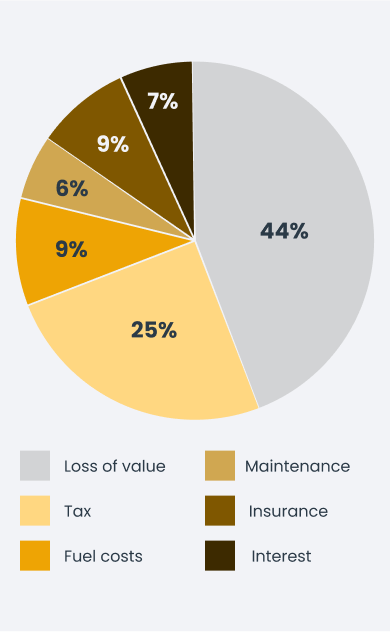

The total cost of ownership shares of a typical E-segment diesel vehicle of a business customer in the United Kingdom in 2016 based on a three-year holding time:

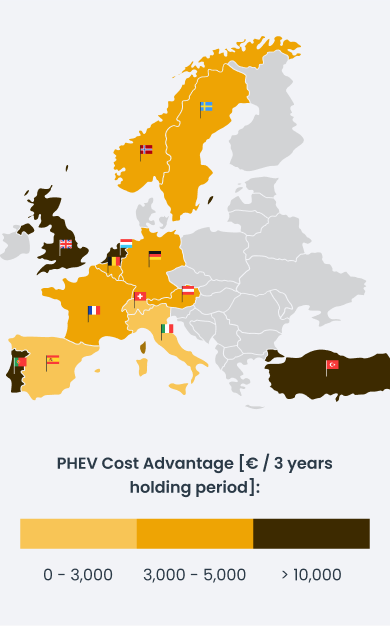

The overall tax advantage of a plug-in hybrid electric vehicle (PHEV) compared to a conventional car in the E-segment for a business customer. This comprises purchase subsidies, registration taxes at the point of sale, yearly ownership taxes paid by the employer, and company car taxes paid by the employee:

The total cost of ownership shares of a typical E-segment diesel vehicle of a business customer in the United Kingdom in 2016 based on a three-year holding time:

The overall tax advantage of a plug-in hybrid electric vehicle (PHEV) compared to a conventional car in the E-segment for a business customer. This comprises purchase subsidies, registration taxes at the point of sale, yearly ownership taxes paid by the employer, and company car taxes paid by the employee:

Leave your contact details, and we will reach you very soon.

Leave your contact details, and we will reach you very soon.